Exactly how to Take full advantage of the Advantages of a Secured Credit Card Singapore for Financial Development

Exactly how to Take full advantage of the Advantages of a Secured Credit Card Singapore for Financial Development

Blog Article

Exploring Options: Can Former Bankrupts Secure Credit Scores Cards Following Discharge?

One typical inquiry that arises is whether former bankrupts can effectively acquire credit rating cards after their discharge. The answer to this query includes a complex expedition of numerous aspects, from credit rating card alternatives customized to this demographic to the impact of previous economic decisions on future creditworthiness.

Understanding Credit History Card Options

When thinking about credit rating cards post-bankruptcy, people should meticulously assess their requirements and financial circumstance to pick the most appropriate alternative. Protected credit report cards, for circumstances, call for a cash deposit as collateral, making them a feasible selection for those looking to reconstruct their credit background.

Additionally, individuals must pay close focus to the annual percentage rate (APR), elegance period, annual charges, and benefits programs used by different debt cards. By adequately reviewing these aspects, individuals can make informed choices when choosing a credit card that straightens with their monetary goals and circumstances.

Variables Influencing Approval

When applying for credit history cards post-bankruptcy, understanding the aspects that impact approval is necessary for individuals looking for to rebuild their monetary standing. Following an insolvency, credit scores frequently take a hit, making it more difficult to qualify for traditional credit rating cards. Showing accountable financial actions post-bankruptcy, such as paying bills on time and maintaining credit report application reduced, can additionally favorably affect credit scores card approval.

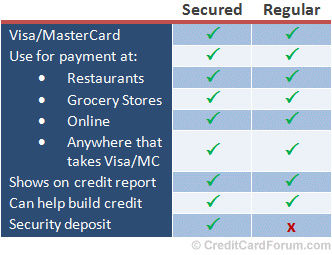

Secured Vs. Unsecured Cards

Protected credit scores cards require a cash money down payment as collateral, usually equivalent to the debt restriction extended by the provider. These cards normally use higher credit limits and reduced rate of interest prices for individuals with good credit history scores. Inevitably, the option in between protected and unsafe credit score cards depends on the individual's financial circumstance and credit report goals.

Structure Credit Scores Responsibly

To efficiently rebuild credit post-bankruptcy, developing a pattern of accountable credit history usage is important. In addition, maintaining credit history card balances reduced family member to the credit scores limit can favorably affect credit rating ratings.

One more strategy for constructing credit history responsibly is to check credit score reports regularly. By assessing credit go score reports for mistakes or signs of identification burglary, individuals can resolve issues without delay and maintain the precision of their credit rating. Additionally, it is suggested to abstain from opening up multiple new accounts simultaneously, as this can signal monetary instability to potential loan providers. Rather, concentrate on gradually branching out credit rating accounts and showing regular, responsible credit report behavior in time. By adhering to these practices, individuals can slowly restore their credit history post-bankruptcy and job in the direction of a healthier economic future.

Reaping Long-Term Conveniences

Having established a foundation of responsible credit report administration post-bankruptcy, people can currently concentrate on leveraging their enhanced credit reliability for long-lasting monetary advantages. By continually making on-time repayments, keeping credit history use low, and monitoring their credit records for accuracy, former bankrupts can gradually reconstruct their credit history. As their debt ratings enhance, they Check Out Your URL may come to be eligible for better bank card supplies with reduced rate of interest and higher credit line.

Gaining long-term take advantage of enhanced creditworthiness expands beyond simply credit report cards. It opens doors to favorable terms on car loans, home loans, and insurance premiums. With a solid credit report, individuals can bargain far better rate of interest on loans, possibly saving hundreds of dollars in rate of interest repayments with time. Additionally, a positive credit rating profile can improve work prospects, as some employers may inspect credit score reports as part of the employing procedure.

Final Thought

.png?width=800&height=250&name=Rewards%20Upgrade%20Campaign_BLOGARTICLE_800x250%20(1).png)

In conclusion, former insolvent people may have problem safeguarding bank card following discharge, however there are alternatives available to help restore credit rating. Comprehending the various kinds of charge card, factors influencing authorization, and the importance of responsible credit report card use can aid people in this scenario. By picking the appropriate card and utilizing it sensibly, previous bankrupts can progressively boost their credit history and gain the lasting advantages of having access to credit score.

Showing accountable monetary habits post-bankruptcy, such as paying expenses on time try this out and keeping credit scores usage low, can additionally favorably affect credit report card approval. Additionally, keeping credit scores card balances reduced loved one to the credit score limitation can positively impact credit ratings. By constantly making on-time repayments, keeping credit application reduced, and checking their credit records for precision, former bankrupts can slowly reconstruct their credit history scores. As their credit rating scores increase, they may end up being eligible for better credit scores card provides with lower interest prices and higher credit history limits.

Understanding the various types of credit scores cards, factors influencing authorization, and the relevance of accountable credit score card use can help people in this scenario. secured credit card singapore.

Report this page